For nonprofits, managing donations efficiently and cost-effectively is crucial. PayPal offers a convenient and widely-used platform for processing donations, but understanding the associated fees is essential for maximizing the benefits. In this article, we will explore PayPal’s processing fees for nonprofits, how they compare to standard fees, and tips for minimizing costs.

PayPal’s Nonprofit Discounted Rates

PayPal offers special discounted rates for verified nonprofit organizations. These rates are lower than standard commercial rates, allowing nonprofits to retain more of their donations. As of 2023, the standard processing fee for nonprofits in the U.S. is 2.2% + $0.30 per transaction. This is a reduction from the typical 2.9% + $0.30 fee for regular accounts.

How to Qualify for Nonprofit Rates

To benefit from PayPal’s nonprofit rates, your organization must:

- Register as a Nonprofit: Ensure your organization is registered as a nonprofit with the appropriate state or national authorities.

- Verify Your Account: Complete PayPal’s nonprofit verification process, which typically involves providing documentation such as your IRS 501(c)(3) determination letter.

- Maintain Compliance: Adhere to PayPal’s policies and guidelines for nonprofits to continue benefiting from reduced fees.

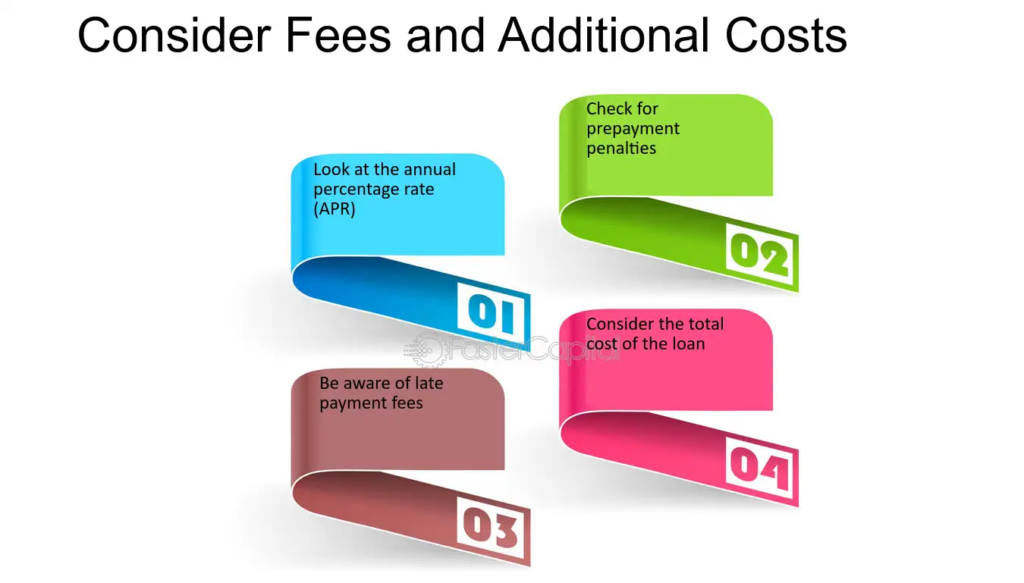

Additional Fees to Consider

While the primary processing fee is a critical factor, there are other fees to consider:

- Cross-Border Transactions: For international donations, PayPal charges an additional fee of 1.5%.

- Currency Conversion: If donations are made in a foreign currency, PayPal’s currency conversion fee applies.

- Micropayments: For small transactions, PayPal offers a micropayment fee structure, which may be beneficial depending on your average donation size.

Comparing PayPal to Other Payment Processors

When evaluating PayPal’s fees, it’s helpful to compare them with other popular payment processors:

- Stripe: Stripe offers a nonprofit rate of 2.2% + $0.30 per transaction, similar to PayPal.

- Square: Square’s fees for nonprofits are generally higher, typically at 2.75% per transaction.

- Network for Good: This platform charges 3% for donation processing, but also offers additional fundraising tools and donor management services.

Tips to Minimize Processing Fees

To maximize the amount of each donation that goes directly to your cause, consider the following strategies:

- Encourage Larger Donations: Larger donations incur the same fixed transaction fee ($0.30), which reduces the overall percentage taken by PayPal.

- Promote Monthly Giving: Recurring donations can help stabilize revenue and reduce the impact of transaction fees over time.

- Explore Grant Programs: Some grant programs may cover processing fees as part of their support for nonprofits.

- Educate Donors: Inform donors about the option to cover the processing fees themselves. Many donors are willing to add a small amount to their donation to cover these costs.

Conclusion

PayPal processing fees for nonprofits are designed to be more affordable than standard rates, helping organizations retain more of their valuable donations. By understanding these fees, qualifying for nonprofit rates, and implementing strategies to minimize costs, nonprofits can effectively leverage PayPal to enhance their fundraising efforts. With careful management, PayPal can be a powerful tool for supporting your nonprofit’s mission and expanding its reach.